Negative Test Scenarios for Banking Testing

by Viktoria Byk | October 25, 2016 8:02 am

Note: this article was updated in October 2019.

In 2019, banking systems get closer to their clients, especially in the last 10 years. The banking system has changed very dramatically: for us, the bank on the phone or computer is a familiar thing. Instead of letters and long lines, we got notifications and online chats with bank workers.

But what does a good banking application mean today? For a great job of an app, it needs mobile, cloud and the Internet covering. We know you came to our blog for learning about the testing of all these aspects of Banking Apps[1], so we prepared the main challenges and their solutions in this article.

Why testing Banking app is often a challenge?

We at QATestLab have got 7 years of experience in testing Banking apps. Analyzing the cases we’ve worked with, we caught something similar: requirements to satisfy clients from the first seconds of using.

Users don’t need to fill out each field by themselves

We tested the banking app where one of the tasks was to check the filling out of various application forms for various banking services. Before choosing a service package, new users had to fill out the information about themselves. And it’s a problem for users: people don’t like to click a lot, especially put down a lot of personal information.

In one of our projects with banks, the owner wanted to facilitate this process, as there it was necessary not only to enter the name/surname but also passport details, registration data and so on.

Here’s what our QA engineer Anna Byblyk said about the solution for this requirement:

“To facilitate this process, we decided to use the DaData service API for hints when filling in the fields and for substituting values in other fields. For example, the user fills in the field “who issued the passport”, starts to enter the first characters, and he immediately sees a drop-down list.”

With this solution, the project returned to the developers, as it was necessary to allow managers to receive mail requests for a new program after API connection[2].

Card processing

The frequent challenge for Banking Apps is card processing and extra features like additional user actions (Negative tests for banking testing).

“There were only 2 options: either the order was agreed or declined without explanation, so a 3d secure check was introduced for more adequate data processing.” -, says QA engineer at QaTestLab Dmytro Sakharov.

In one of our cases, the challenge of a program was to register loans. Our task was to verify that the KYC credit status was correctly displayed. It was necessary to check the various datasets and the proper operation of the applet itself. If the users had a wrong date of birth in the profile, they could not take the credit without answering additional questions – the mother’s name and selfie check.

For this challenge, our experts have entered 3d secure. It was necessary to test the order through the types of cards with 3d secure because there are special card numbers that trigger additional checks. These checkings depend on the card number and cover all possible options for real cards.

“Part of the card’s status depends on the geolocation of the users. If they are within a radius of 50 km from the office, registration gives them status.” -, says QA engineer at QaTestLab Dmytro Sakharov.

The credit applications

For the credit app, we got developers to clone the database of real users to the test server. In such a way it becomes possible to check the correctness of the statuses for each credit with different variants of documents and data types. Then, partially, autotests are introduced[3] to check the main scenarios, where no additional checks are necessary.

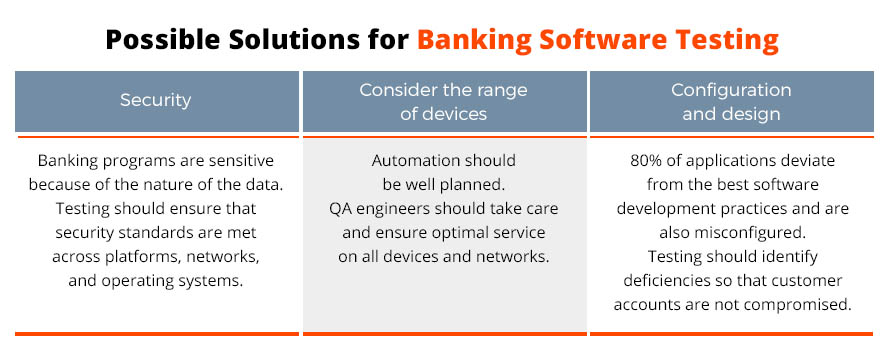

Challenges of Banking software and their possible solutions

Banking is a serious and important part of everyone’s life. It must work better than a clock using a negative scenario for baking software testing.

Our testers are always ready for challenges and share their list of possible solutions.

Conclusion

QA teams should be informed and carefully follow a developed strategy to ensure the success of the future product for the Banking sphere. That’s why they must remember about negative tests for banking software testing. The future may bring even more areas where quality teams need to focus, but those areas remain in the hands of customers. Some relevant critical fields will be secondary to the testing process, as the mobile banking market grows and evolves, but security will not be one of them.

Learn more from QATestLab

Related Posts:

- aspects of Banking Apps: https://qatestlab.com/resources/case-studies/business-solutions/protected-bank-client/

- API connection: https://blog.qatestlab.com/2017/07/12/api-secutiry-threats/

- autotests are introduced: https://qatestlab.com/services/test-automation/

- What is PSD2 (Payment Service Directive 2) about?: https://blog.qatestlab.com/2019/11/07/payment-service-directive-2/

- Specifics of Security Testing of Banking App: https://blog.qatestlab.com/2015/01/21/what-is-specificity-of-security-testing-of-a-banking-application/

- Why is Verification of Banking App Databases Complex?: https://blog.qatestlab.com/2015/01/20/why-is-verification-of-banking-application-databases-complex/

Source URL: https://blog.qatestlab.com/2016/10/25/banking-system-testing/